Miércoles 18 de junio de 2025 · De 9:20 a 13:30 h · Presencial · Gran Casino de Vila-real (Castellón)

Inscripción gratuita: Formulario de inscripción

La Cátedra de Medio Ambiente Industrial de la Universitat Jaume I, junto con el Ayuntamiento de Vila-real, la Asociación Española de Técnicos Cerámicos (ATC) y otras entidades colaboradoras, organiza una jornada técnica centrada en el papel clave que juegan los gases renovables en la descarbonización de sectores industriales.

Esta sesión formativa y de debate está especialmente dirigida a sectores con consumo intensivo de gas natural, como el cerámico, y se enmarca dentro de los objetivos del Horizonte 2030 para una transición energética sostenible.

Objetivos de la jornada

Durante la jornada se abordarán:

-

El estado actual del biogás en España y su evolución.

-

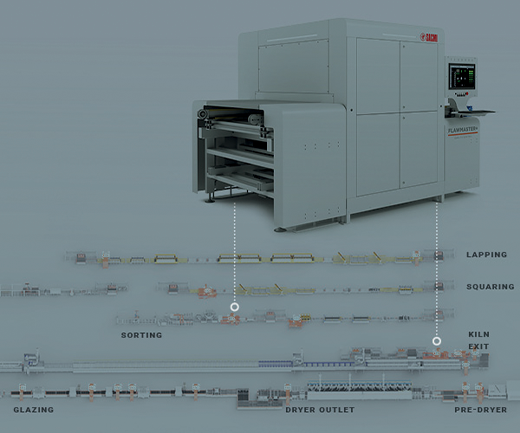

Las tecnologías de purificación e inyección de biometano en la red gasista.

-

El sistema de garantías de origen y su relevancia en la trazabilidad del biometano.

-

El papel del hidrógeno renovable como vector clave para la descarbonización industrial.

-

Un debate abierto entre representantes del sector cerámico y energético.

Programa

09:20 h – Apertura institucional

Intervendrán:

-

José Benlloch, Alcalde de Vila-real

-

Eliseo Monfort, Director de la Cátedra de Medio Ambiente Industrial (UJI)

-

Juan José Montoro, Presidente de ATC

09:30 h – Situación del biogás en España

Luis Puchades, Presidente de AEBIG

10:05 h – Upgrade e inyección de biometano

Vicente Gramuntell, Director de Desarrollo de Nedgia

10:40 h – Coffee break

11:00 h – Garantías de origen del biometano

Trazabilidad y certificación en el mercado energético

11:35 h – Hidrógeno renovable y descarbonización industrial

12:10 h – Mesa diálogo sectorial

Modera: Eliseo Monfort (UJI)

Participan: ASCER, ANFFECC y otros representantes del sector energético

Una visión compartida sobre los retos y oportunidades reales para el uso de gases renovables en el tejido industrial.

Lugar de celebración

Gran Casino de Vila-real

Carrer Major Sant Jaume, 7 – Vila-real (Castellón)

La inscripción es gratuita pero con aforo limitado. Reserva tu plaza a través del siguiente enlace:

https://atece.org/papel-de-los-gases-renovables-en-la-transicion-energetica/