Review of IMFORMED’s inaugural Salt Forum 2022 Hamburg

In response to market demand, IMFORMED launched its inaugural Salt Forum in Hamburg last year at the Grand Elysée Hotel, 15-17 November. And what a success it turned out to be!

The event drew leading international players and experts from across the salt industry spectrum to present, discuss, and network across a wide range of topics shaping the market’s outlook – these included global market overviews, solar salt, desalination, Canada’s new source, MENA production, food grade salt, salt recovery, and salt drying innovations (reviewed below).

Title Image Sunshine on Salt: the operations of Walvis Bay Salt cover 5,000ha on the coast of Namibia, the largest producer of solar sea salt in sub-Saharan Africa; 90m m3 of seawater is processed to produce >900,000 tpa of high quality salt; Salt Forum 2023 includes a visit to this facility. Insets: Deicing is one of salt’s primary markets; Patrick Laracy, CEO, Atlas Salt speaking at Salt Forum 2022. Courtesy Walvis Bay Salt

The overall programme was good and knowledge orientated, good venue and well managed.

Sateesh Marihal, Manager Operations, Chowgule & Co. (Salt) Pvt Ltd, IndiaGood programme, interesting conversations, and good audience.

Ruud Cleveringa, Sales Manager De-icing Salt, ICL Europe, NetherlandsI enjoyed the conference very much and thought it was of an excellent quality.

Nils van der Plas, Executive Advisor, NEOM, NetherlandsFree Fluorine Forum 2022 Summary Slide Deck Download here

Missed attending the Forum? A full PDF set of presentations available for purchase.

Please contact Ismene Clarke T: +44 (0)7905 771 494 ismene@imformed.com

This vital industrial mineral, of which about 335m tonnes is produced worldwide and 50m tonnes exported by >50 countries, deserves a regular, well-organised conference, providing an international networking and knowledge sharing hub.

IMFORMED aims to fulfil this requirement in light of the demise of the World Salt Symposium, and more recently, Roskill’s Salt Conference. Salt Forum 2022 has given the initiative a fantastic start and demonstrated the industry’s appetite for such a conference.

To that end, we are delighted to invite the market to join us on the beautiful west coast of Namibia for Salt Forum 2023, at the Strand Hotel Swakopmund, Namibia, 6-9 November 2023, with the exclusive opportunity to visit the operations of Walvis Bay Salt, the largest producer of solar sea salt in sub-Saharan Africa, as well as participate in a range of spectacular sight-seeing activities – Full Details Here.

FULL DETAILS HERE

SALT MARKET OVERVIEWS

Preceding the conference we were delighted to host a 1-Day Salt Training Seminar “Everything you Ever Wanted to Know about Salt”, devised and supervised by Vladimir Sedivy, President, Salt Partners Ltd, co-operating with Stefan Schlag, Owner, Salt Market Information.

The select delegate group enjoyed a focused seminar on a range of topics including salt properties, resources, production, processing, handling, marketing, consumption, economics and environmental issues.

Following a very convivial evening Welcome Reception, the conference opened with series of market overviews before sessions on more specific industry aspects.

The world of salt supply & demand

Mike O’Driscoll, Director, IMFORMED, UK

O’Driscoll introduced the conference with a brief scene-setter, highlighting the key features of salt production, trade, and demand.

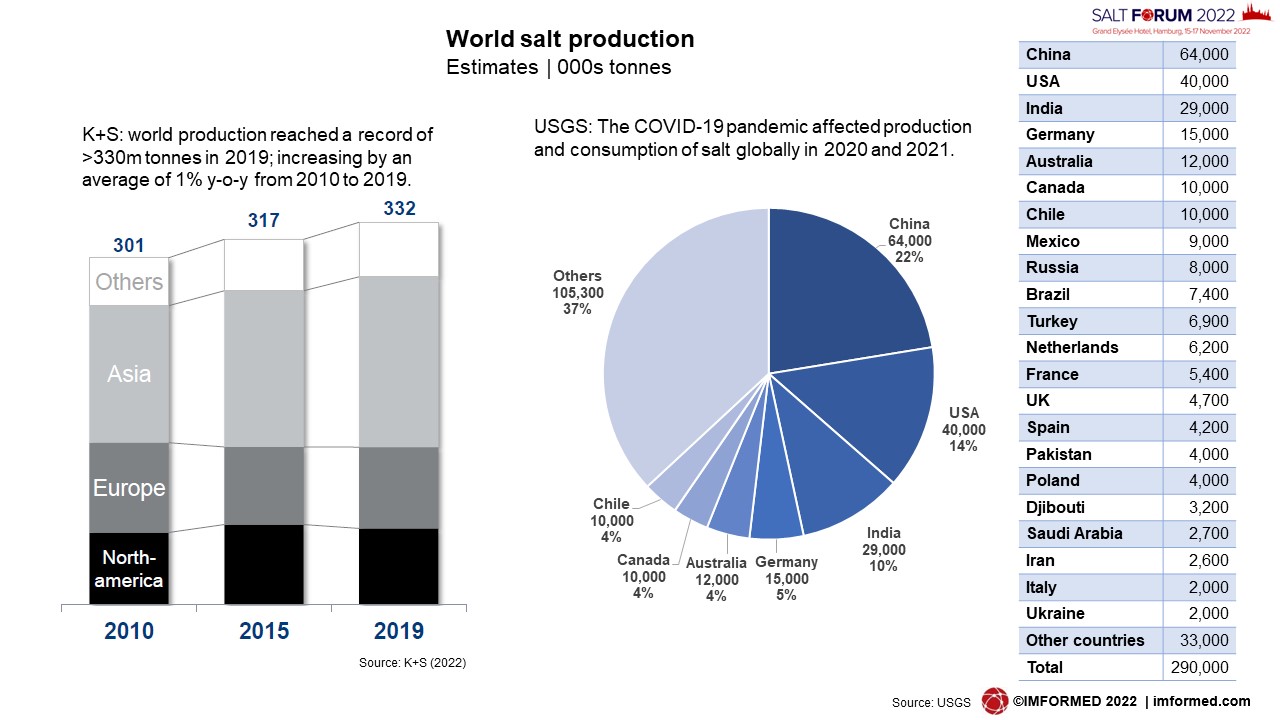

The COVID-19 pandemic affected production and consumption of salt globally in 2020 and 2021. World production reached a record of >330m tonnes in 2019, increasing by an average of 1% y-o-y from 2010 to 2019.

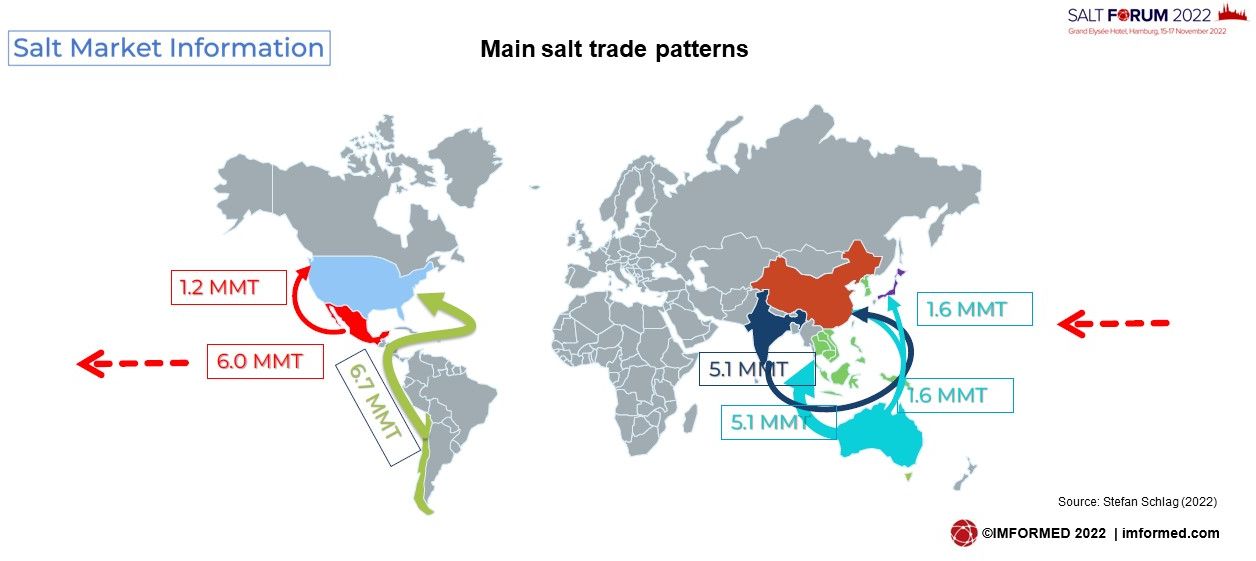

In 2021, the USA was the largest salt importer, at 24.7m tonnes, sourcing from Chile, Canada, Mexico, and Egypt.

Deicing and chloralkali chemicals were the primary uses for salt, together, with almost equal shares, accounting for 81% of US consumption in 2021. The European salt market is dominated by chemicals, 53%, followed by deicing, agriculture, water treatment, and others.

New emerging salt source projects in Canada and Australia were also highlighted.

Salt market trends & outlook

Stefan Schlag, Salt Market Information, Switzerland

Schlag outlined the main reasons for future uncertainty in the market, which is expected to remain, and focused on possible scenarios and their impact on the salt market, noting that impacts differ with world regions and downstream markets.

Recession will have a small effect on economic cycles on salt consumption in food, feed, water treatment, medical and pharmaceutical uses. However, use of salt in the chemical industry will have a pronounced effect.

Salt consumption is expected to grow globally, with the main growth driver being increasing demand from the Asian chemical industry. The expected recession, and the war in Ukraine will lead to slow growth or stagnating salt consumption in North America and Western Europe.

Decreasing consumption of salt is also expected in the important high volume de-icing market. Reasons are the more efficient use of salt, and in the longer term the effects of climate change.

Additional capacities from large scale solar salt-rock salt, and recycling salt projects may be absorbed at slower than expected rates.

Global salt supply: growth market insight & developments

Euston Witbooi, Research Analyst, Project Blue, South Africa

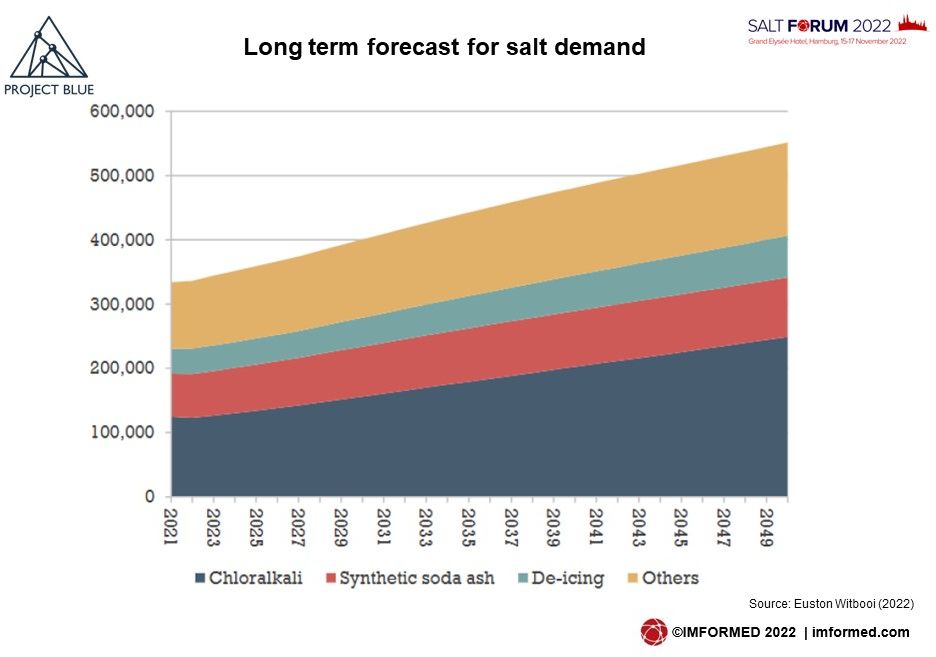

Witbooi reviewed salt demand and long term outlook, the drivers of salt demand, the supply landscape, growth market insights, forecasts, new projects, ramp ups and potential shortages.

Global salt demand is forecast to be greater than 500m tonnes by 2050 with growth driven by the chloralkali industry. The current supply deficit could be prolonged over the medium term if key solar salt projects do not come on stream as expected.

The current and future variability of supply from key salt producing countries due to climate change is a major concern as it can significantly impact supply chains, especially exports.

With an increased focus on ESG factors determining the feasibility of potential projects, the lead time for projects to come on stream may be prolonged, again having the potential to impact supply chains.

SOLAR SALT | DESALINATION

Solar salt for the chlor-alkali market

Vladimir Sedivy, President, Salt Partners Ltd, Switzerland

Sedivy started by comparing the different salt production processes by share of world production and relative purity yielded, highlighting the significant increase in detected impurities over the years.

Brine purification costs were then examined in relation to salt prices, before discussing the principles and merits of the HYDROSAL Process.

Sedivy concluded that solar salt can reach the quality of vacuum salt at a fraction of vacuum salt cost:

- High purity salt makes primary brine purification redundant

- With pure salt, anion removal systems are not required

- With pure salt, membrane life of up to 8 years is possible

- With pure salt, plant operating cost is reduced

- With pure salt, plant extra capacity is not required

- With pure salt, loss of production is avoided

- High purity salt can be EUR 20.33 / t or 74.6% more expensive than washed salt for the same chlorine production economy calculated in the example

- Each case must be examined considering specific costs

NEOM project: will ZLD desalination be a gamechanger for the global salt market?

Nils van der Plas, Executive Advisor, NEOM, the Netherlands

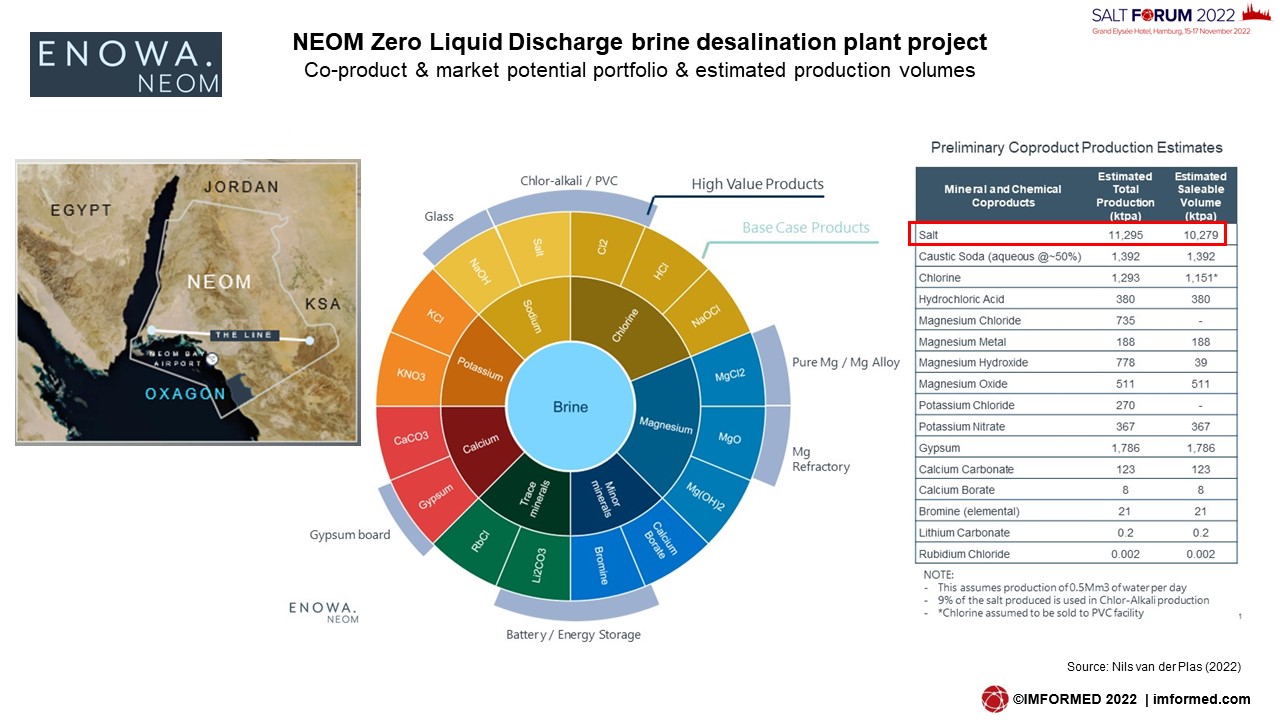

A most intriguing and ambitious project was explained by van der Plas which, in his words, will generate the question: “Will the future of water determine the future of salt?”

NEOM is a planned “smart city” in Tabuk province in north-west Saudi Arabia. NEOM stands for New Future, and is a combination of the Greek Neo (new) and the Arabic Mim/Mustaqbal (future).

An adequate water supply will of course be a paramount requirement for such a new city. Enowa, the energy, water, and hydrogen subsidiary of NEOM, ITOCHU, and Veolia, have agreed to collaborate to develop a first-of-its-kind selective brine desalination, Zero Liquid Discharge (ZLD) plant powered by 100% renewable energy in Oxagon, NEOM’s planned advanced manufacturing and innovation city.

Van der Plas set out to explain how ZLD desalination may change the competitive landscape of salt.

NEOM will need 500,000 m3/day water in Phase 1 (two trains of 250,000 m3/day), and for Phase 2 another 250,000 m3/day.

The planned ZLD plant to meet this water demand is expected on stream in 2024. As well as producing water, the project envisages an impressive array of commercially useful co-products: an estimated annual production of 11.3m tonnes salt, and in addition, volumes of caustic soda, chlorine, magnesium hydroxide, magnesium oxide, gypsum, and lithium carbonate among others (see chart).

It was outlined how NEOM sourced salt could supply the primary consuming market sectors of salt, taking advantage of the ZLD plant’s high purity brine source, low energy costs, and optimal logistics.

Van der Plas suggested the ZLD Desalination initiative could start a move towards “Ocean Brine Mining” and away from sensitive underground salt mining operations in a highly populated Europe and/or huge land occupation in key development areas.

There is no doubt that should NEOM come to fruition, it would certainly have some impact on the salt market.

Van der Plas concluded by saying: “NEOM invites you to re-invent the salt value chain, starting upstream, towards 100% sustainability.”

REGIONAL SUPPLY

North American salt market

Patrick Laracy, CEO, Atlas Salt Inc., Canada

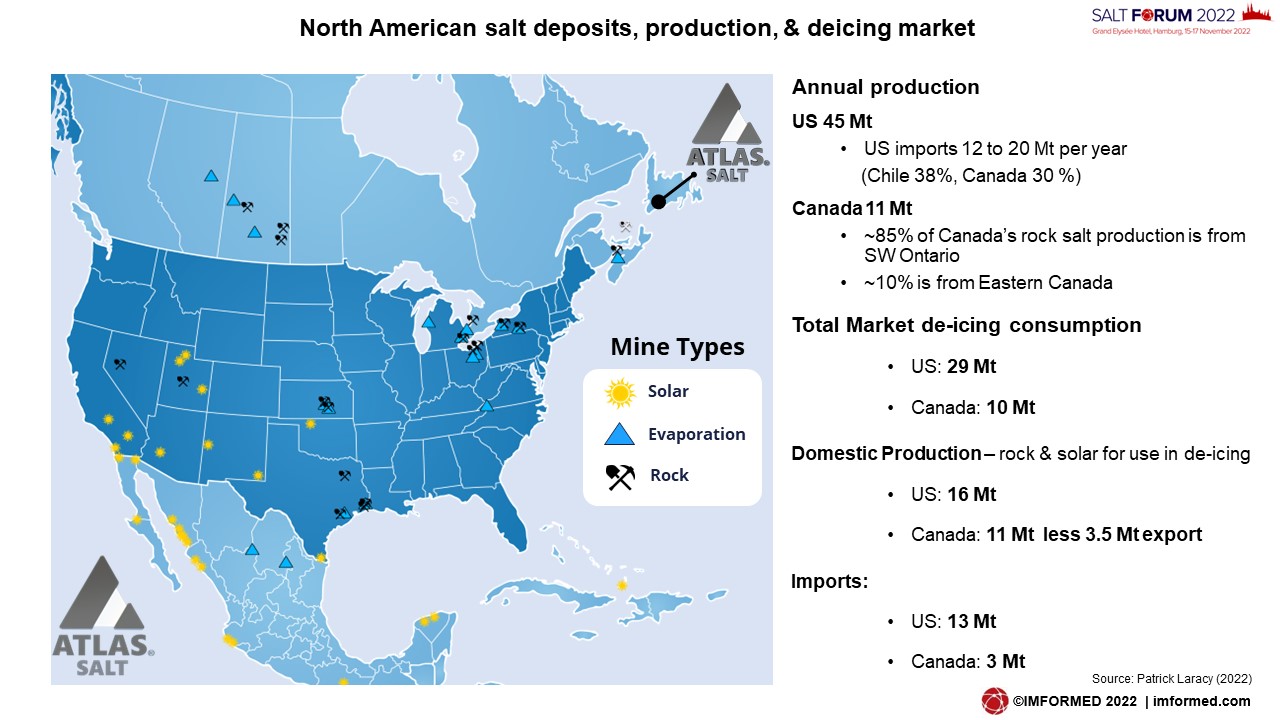

Laracy provided a fine summary of the North American salt market covering the main salt deposits by type, production, and the mine locations, before focusing on the deicing market, which totals almost 40m tpa salt.

The US imported 14.7m tonnes of salt in 2021, a net import reliance of 30%; import sources of salt since 2014 have included Chile (42m tonnes in total), Canada, Egypt, Mexico, Brazil, Bahamas, Peru, and Morocco.

Primary domestic salt markets by region are: East Coast – New England, 3-5m tonnes; Mid Atlantic, 4-6m tonnes; US Mid-West – Great Lakes 7-8.5m tonnes; River Supply 7-8m tonnes; Canada – Ontario 3-4m tonnes; Atlantic Canada, 3.5-5m tonnes.

The main influencing factors for the North American salt industry are:

- Shipping cost volatility / Supply Chain

- Fuel costs / emissions

- ESG considerations

- Climate change

- Average mine age 71 years … Last mine 22 years then 50 years

- Mississippi water issues – barge traffic

- Consumption projected to increase

Laracy then introduced Atlas Salt’s Great Atlantic Project, which features the shallowest salt deposit in North America being advanced toward a mine, and is located in the heart of the robust eastern North America road salt market.

Great Atlantic would become the first salt deposit in North America accessed through inclined ramps versus more costly vertical shafts, upon potential production

The project is envisaged as a highly efficient, low cost and scalable decades-long producer that can significantly reduce reliance on overseas imports.

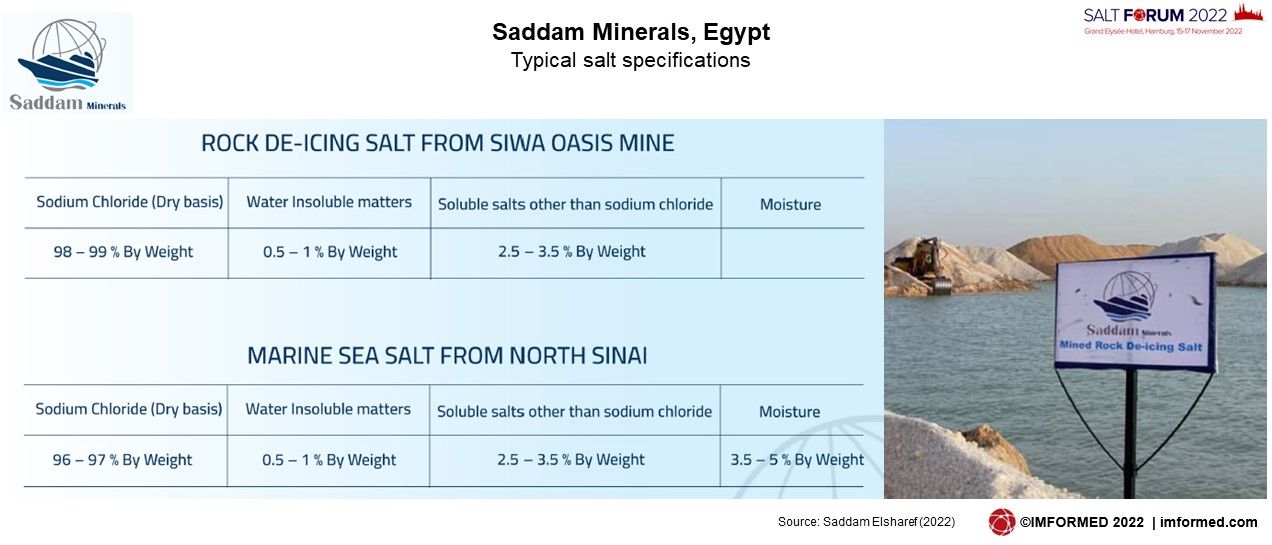

Rising global demand for Egyptian deicing salt

Saddam Elsharef, President, Saddam Minerals Co., Egypt

Salt from Egypt is well known for its high purity. The country’s production ranges 2.5-3.5m tpa, with about 1.5m tpa consumed in domestic markets, with the remainder exported for deicing in Europe and North America.

Established in 1990, Saddam Minerals is one of the leading salt producers of Egypt producing 700,000 tpa rock salt from its Siwa Oasis mine and 500,000 tpa marine salt from its North Sinai mine.

Saddam Minerals is looking to increase its production to 1.5m tpa.

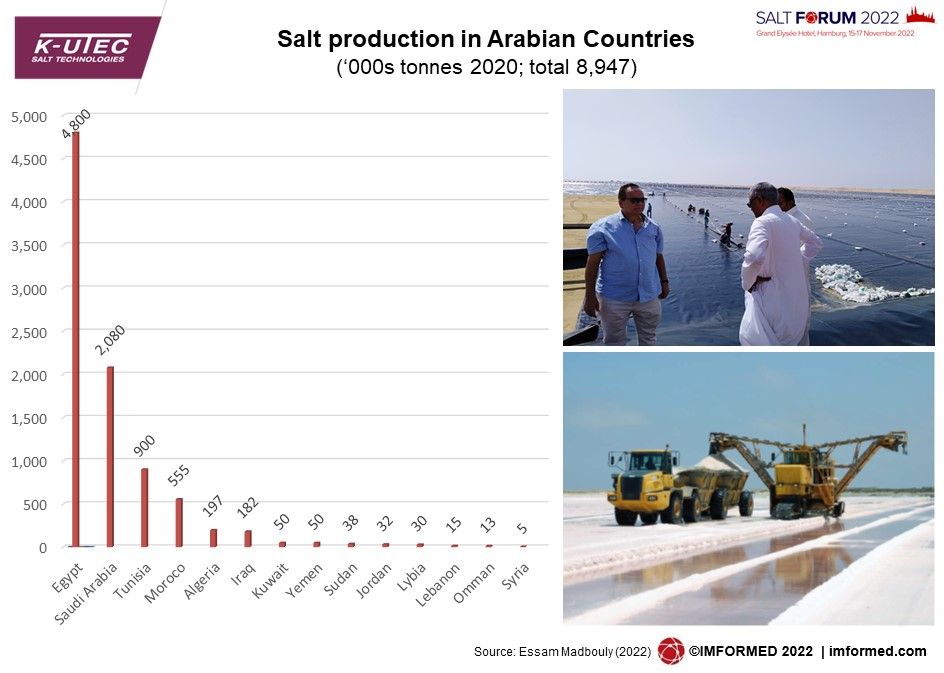

Salt production in the MENA region

Essam Madbouly, Consultant, K-UTEC AG Salt Technologies, Germany

Madbouly presented an overview of salt production and demand in the MENA region, including a focus on Saudi Arabia.

He reviewed the parameters for constructing a solar salt operation in the region, and focused on examples of solar salt operations in Egypt, the UAE and Saudi Arabia.

The Shuaiba Solar farm was highlighted as the largest solar salt farm in the Gulf area located 120km south of Jeddah with an area of 5.7m m2 and production capacity of 300,000 tpa salt.

The solar salt industry is unique in its requirements for successful operation, which differ from any other industry. Solar salt projects depend upon:

- Site location property.

- Good climatic conditions.

- A good bearing for soil .

- Salinity of intake brine and phase chemistry.

- High technology for washing salt unit.

FOOD GRADE | RECOVERY FROM DRILLING FLUIDS

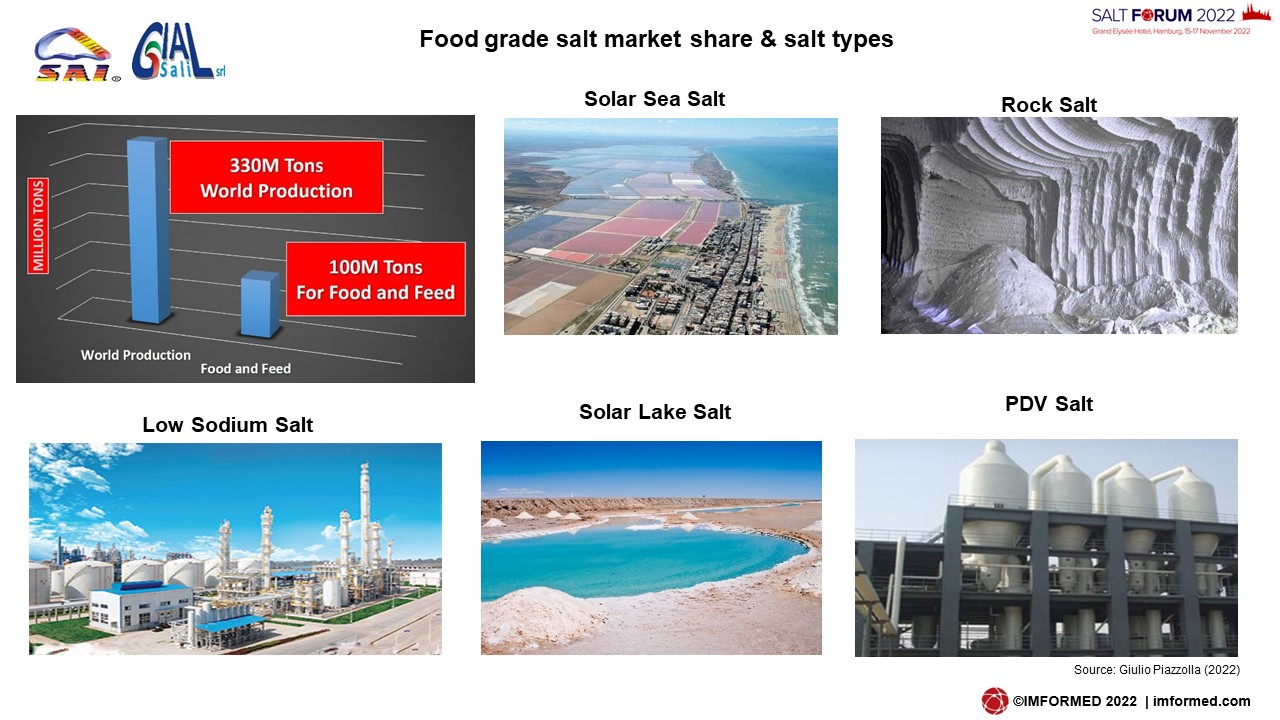

Food grade sea salt demand growth: the boosting factors

Dr Giulio Piazzolla, Export Director, SAI-Sali Alimentari e Industriali srl, Italy

Piazzolla started by outlining the different salt types which contribute to the annual 100m tonnes of salt consumed in food.

Sea salt is the salt source of choice for consumers and food processors, mainly down to its unique sensory taste, health and ethnic purposes, and mandatory regulation and fortification.

Piazolla explained the mandatory certifications, fortifications and labelling required for salt grades supplied for both human and animal food consumption.

Food grade sea salt demand is growing by some 2.8-3.5% annually. Key influencing factors on market demand include increasing population, changing lifestyles, and force majeure events (eg. pandemic, war, weather). Costs for packaging and logistics have also risen.

There are two technologies which can support cost reduction and de-carbonisation efforts in the salt manufacturing industry: the implementation of electric boilers to generate steam; and the implementation of mechanical vapour recompressors (MVR) to vaporise the brine.

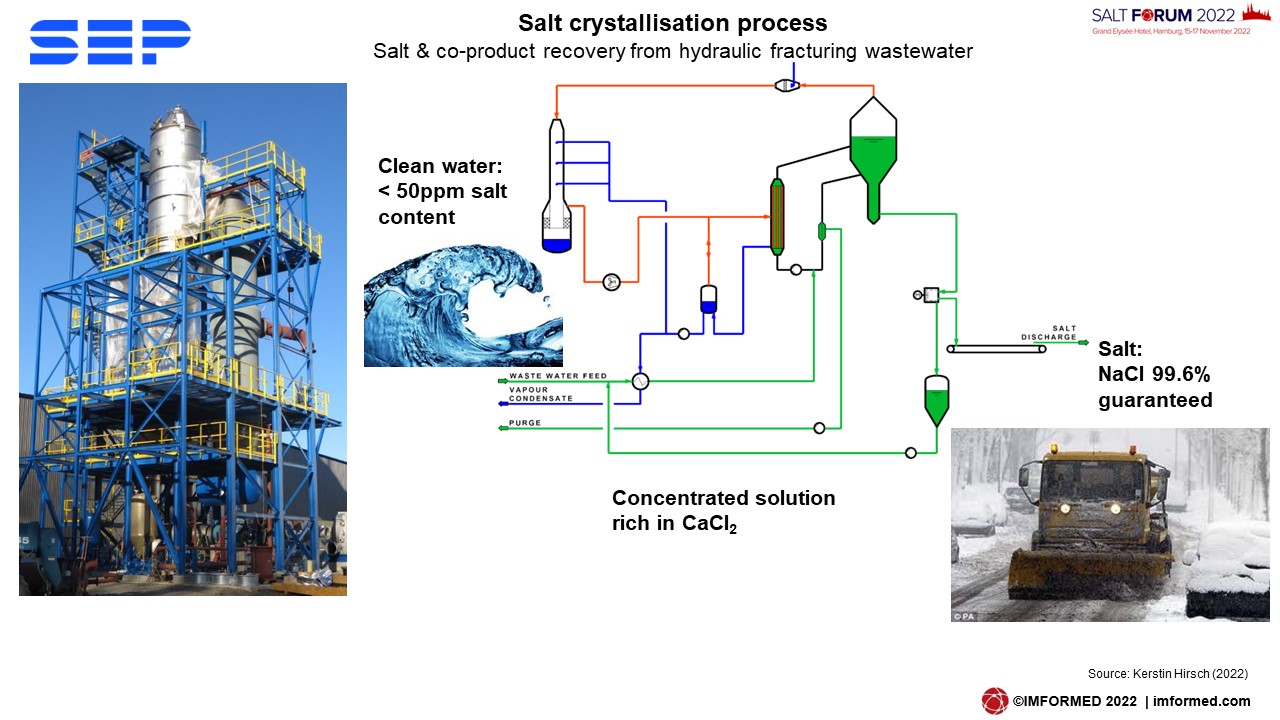

Recovery of salt from produced water coming from shale gas applications

Kerstin Hirsch, Business Development Manager, SEP Salt & Evaporation Plants Ltd, Switzerland

Recycling of salt is evolving fast as producers and users alike strive to make their operations and processes more sustainable. Here, Hirsch provides an interesting example of salt recovery from shale gas fracking.

Hirsch provided an overview of hydraulic fracturing, related waste water handling, before concentrating on the case study of waste water crystallisation.

The waste water from fracking has high salinity, contains chemicals, hydrocarbons and naturally occurring radioactive materials.

Treatment options are challenging, and changing compositions and unknown constituents require flexibility and good know-how for the selected treatment methods.

However, as Hirsch demonstated, it is possible to crystallise salt of road salt quality, and moreover, have zero liquid waste material at the end of the treatment chain, with the added bonus of recovering co-products such as calcium chloride, strontium chloride and barium chloride.

SALT DRYING TECHNOLOGY

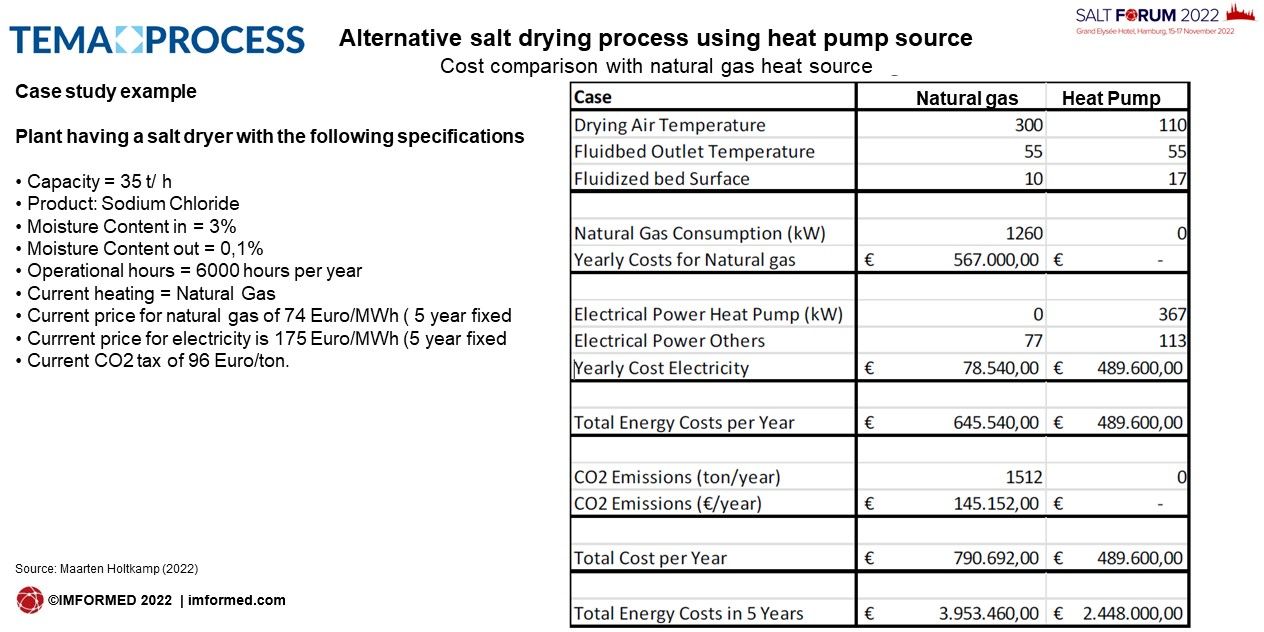

Developments on fossil fuel free drying of salt using low temperature fluidised bed technology

Maarten Holtkamp, Commercial Director, TEMA Process BV, Netherlands

Holtkamp explained that to use salt, drying is needed to achieve the required humidity using fossil fuel combustion.

The extreme fluctuations on price and delivery stability of fossil fuels, and not least the impact on climate change, means that with current drying technology the salt industry is very vulnerable to these impacts.

The current solution for drying of salt is the use of fluidised bed technology using fossil fuel as a heating source, drying air temperatures up to 350°c, and alternative use of electric heaters.

Holtkamp outlined TEMA’s alternative solution: the design of a low temperature dryer, only working at 120°C max., using integration of a heat pump as an alternative heating source compared to a burner.

A heat pump is a device that transfers heat at low temperature to a high temperature using a mechanical force. Exhaust gases are also used as a heat source to avoid loss of energy.

Use of the new dryer can reduce energy consumption by >65% and can reduce energy costs by >30%. Employment of solar panels (PV) will further improve the OPEX, and CO2 emissions are avoided.

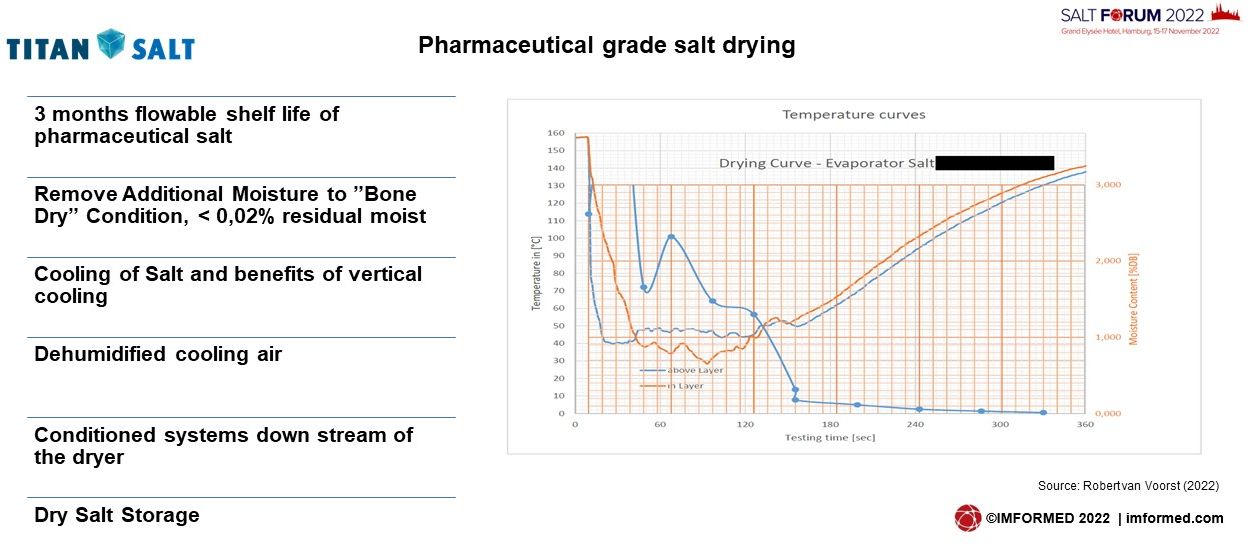

Innovations in salt drying systems

Robert van Voorst, Managing Director, Titan Salt, Netherlands

Van Voorst outlined Titan Salt’s technology and integrated approach to salt drying processes.

This included a review of the integrated system design, dewatering and drying, reduction of energy usage (in the dryer), slurry highway design, E-Leg salt slurry extraction, designed head tank, wet salt feed configuration, automatic power wash system, and pharmaceutical salt grade drying.

Thanks & hope to see you at Salt Forum 2023 Swakopmund, Namibia!

We are indebted to the support and participation our partners, speakers, and delegates for making our inaugural Salt Forum 2022 such a success, and ensuring a fruitful and most enjoyable time was had by all.

We very much look forward to meeting you again and repeating the experience, but this time on the spectacular coast of Namibia!

Please join us at Salt Forum 2023, at the Strand Hotel Swakopmund, Namibia, 6-9 November 2023, with the exclusive opportunity to visit the operations of Walvis Bay Salt, as well as participate in a range of spectacular sight-seeing activities – Full Details Here.

Registration, Sponsor & Exhibit enquiries: Ismene Clarke T: +44 (0)7905 771 494 ismene@imformed.com

Presentation & programme enquiries: Mike O’Driscoll T: +44 (0)7985 986255 mike@imformed.com

Free Fluorine Forum 2022 Summary Slide Deck Download here

Missed attending the Forum? A full PDF set of presentations available for purchase.

Please contact Ismene Clarke T: +44 (0)7905 771 494 ismene@imformed.com