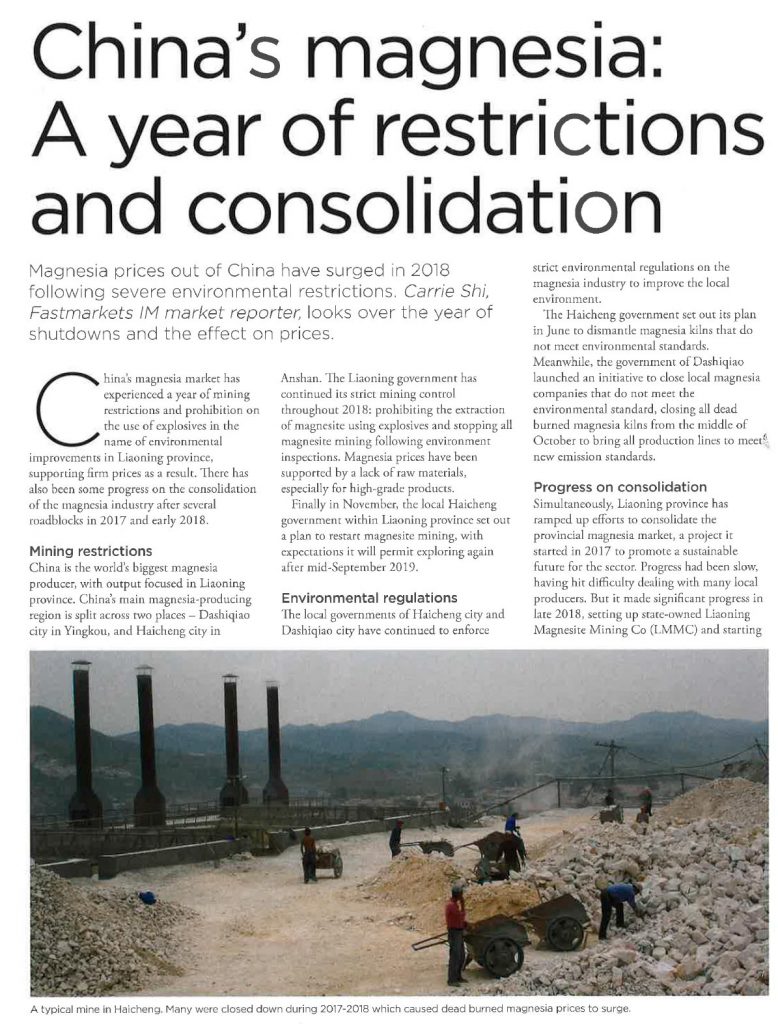

Magnesia prices out of China have surged in 2018 following severe environmental restrictions. Carrie Shi, Fastmarkets IM market reporter, looks over the year of shutdowns and the effect on prices.

Dic 10

Magnesia prices out of China have surged in 2018 following severe environmental restrictions. Carrie Shi, Fastmarkets IM market reporter, looks over the year of shutdowns and the effect on prices.

Dic 02

Prices for two grades of bauxite have ticked downward, as has the price for white fused alumina, but brown fused alumina remained stable, with the market said to be mostly flat on limited activity.

The markets for both bauxite and alumina continued to be weak in early March on slow demand flows in Europe and other consuming areas, while the evolution of the supply situation in China remained unclear.

Fastmarkets assessed the price of calcined bauxite, 85%, at $400-420 per tonne fob China on Thursday March 7, against $410-430 per tonne previously.

The corresponding price assessment for calcined bauxite, 86%, was $420-440 per tonne fob China on the same day, down from $430-450 per tonne earlier.

Fastmarkets’ price assessment for calcined bauxite, 87%, remained unchanged on Thursday at $450-470 per tonne fob China, while the price ofcalcined bauxite, 88%, remained at $470-490 per tonne fob China. The prices for 87% and 88% material dropped by $20-30 per tonne in the previous assessments on February 21.

Market participants spoke of widespread weakness across the market at the moment, especially on the demand side.

The majority of consumers had contracted their supplies in advance for the first part of the year, and many were covered for most of the first half. The slowdown in European industrial indicators, visible since the third and fourth quarters of 2018, also played a part in damping market activity.

As a result, the industry was not taken by surprise by the current weakness.

A number of sources noted, however, that the slowdown has gone further than expected.

«We all knew that this year was going to be slower than 2018, so it’s not necessarily a surprise,» one importer said.

What is notable, though, is that the drop in inquiries has been more significant than we forecast.»

A producer added: «There may have been some excess of optimism on the part of customers at the end of last year. Business has slowed more than expected.»

Nov 25

At present, the raw materials market for the refractories sector is very dynamic. We approached Almatis, who is a well known global player in the alumina business. Emre Timurkan (ET), CEO Almantis, was prepared to share with our readers his views. Emre Timurkan has over 20 years experience in the financial markets, having worked in commercial and investment banks globally. Joing Oyak, Turkey’s largest pension fund in 2017, he was appointed CEO of Almatis in August 2017. Emre Timurkan also serves as a Member of the Oyak Executive Committee, Deputy Chairman of Oyak Anker Bank, and Member of the Board of Oyak Global Investments. He is a graduate of Georgetown University in Washington DC/US with a BSBA in Finance.

Nov 18

China’s central government has launched a new round of strict environmental inspections of heavy industries in provinces including Shanxi, Liaoning, Jilin, Anhui, Shandong, Hubeis, Hunan, Sichuan and Shaanxi.

Five inspection groups from the central government were to go to these provinces between October 31 al November 30, to supervise the application of local environmental regulations and improvements to air condition.

Nov 11

Refwin: A brief introduction of your company, including its development history, strategic objectives, market positioning, products application, etc.

Mr Matthias Normann: Founded in 1979, INTOCAST took over the business activities of Eugen Schwarz GmbH, who had already been supplying the German and European steel industry since 1922 with consumables for iron and steelmaking.

Through mergers and acquisitions, the INTOCAST group has grown over the decades into an enterprise that is now active world-wide. INTOCAST has a strategically selected network of eight German and five foreign operating sites, employing 1350 staff members worldwide with a consolidated Group turnover of approx. EUR 330 million per annum.

The INTOCAST group is one of the few companies to manufacture and market shaped and unshaped refractory products, casting auxiliaries as well as metallurgical slag additives.

As one of the industry leaders, INTOCAST is committed to developing and manufacturing high quality products for its customers, with the goal of ensuring the best possible cost-benefit ratio for our customers worldwide when using our products.

Please refer to www.intocast.de to find more discription of our history, who we are, our objectives and product applications.

Refwin: Do you have new acquisition plans in next 3 years, after taking over the RHIM’s detached dolomite and magnesia-carbon bricks business in Europe?

Mr Matthias Normann: We are currently active with an acquisition in India. The targeted company is Hi-Tech Refractories in Jamshedpur. Apart from substantial existing product range where we could assist with technology, Hi-Tech has a state-of-the-art production facility for isostatically pressed products. Isostatically pressed products were the only missing product type to complete our global product portfolio. Therefore, this acquisition was not only a financial decision but also a strategic one.

The other area where we want to improve our presence is Latin America and we are in the process of identifying a suitable target.

Both above mentioned geographical locations are seen as important markets in order secure the continuous growth of our group. Refwin: What is your global foot print, layout, esp. for China, India, Southeast Asia and other emerging markets? Mr Matthias Normann: For India and Latin America please refer to the above.

The Southeast Asia markets will be managed by INTOCAST Hi-Tech in India. Over the next 5 years we intend to be in a position to produce, manage and source the entire product portfolio from the INTOCAST Group from our Indian unit.

South Africa is traditionally a very important market for us where we have a very strong presence, which we will utilize to promote shaped refractories in order to grow our market share further in the region.

In Russia we decided many years back to enter into a partnership with Magnezit, which works very well for us as they are the strongest player in the market and we complete their existing product portfolio with our product range. On the casting auxiliaries‘side we have established OOO INTOCAST RUS in Voronezh to manufacture casting fluxes locally and give the customers technical support together with our material supplies.

Refwin: In your opinion, what is the core competitiveness for INTOCAST to standing out among global refractories industry?

Mr Matthias Normann: It is the balance between our product lines. All segments, MgO-C shaped, dolomite shaped, unshaped (MgO/Al2O3/Dolo) and casting auxiliaries are very similar in turnover and gross profit. This puts us in a position to recommend to our customers what we believe is the best technical solution instead of seeking solutions to fill our production plants. That, combined with tailor made refractories and fast product development, gives us the cutting edge in market. Refwin: For the future of refractories industry, what development changes do you think are worth looking forward to? Mr Matthias Normann: In my view the price pressure refractory companies have been put under has led to a development into the wrong direction. The focus is on reducing costs rather than developing products to significantly improve the performance of a product in use with the clear target to give the customer a real competitive advantage. In my view «to be competitive» will not be good enough in the near future. Refractories will not be seen as a commodity by the leading companies in the steel sector, but as a tool to improve productivity and quality of steel manufacturing. To reach extraordinary results a complete refractory system is required, which is developed in conjunction with R&D and lining experts, supervised or managed by highly competent site technologists at the customer. I am looking forward to contributing whatever is needed to put our customers ahead of their competitors.